Tax Table For Ira Withdrawals

This guide will take you through how to use the rmd table explain what it means for your retirementand discuss what happens if you don t hit the required minimum distribution for a given year.

Tax table for ira withdrawals. If you decide to withdraw 10 000 multiplying by 0 85 gives a taxable ira withdrawal amount of 8 500. Minimum distribution for this year from this ira. Joe retiree who is 80 a widower and whose ira was worth 100 000 at the end of last year would use the uniform lifetime table. The rmd table the irs provides can help you figure out how much you should be withdrawing.

Quick fact sheet roth ira contributions. 2020 ira contribution levels. It indicates a distribution period of 18 7 years for an 80 year old. For example if you are in the 22 tax.

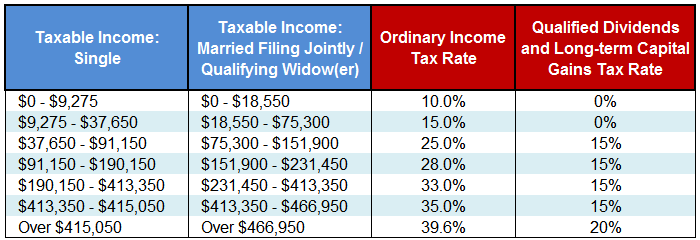

Table iii uniform lifetime age distribution period age distribution period age distribution period age distribution period 70 17 127 4 82 94 9 1 106 4 2 71 16 326 5 83 95 8 6 107 3 9 72 15 525 6 84 96 8 1 108 3 7 73 3 424 7 85 14 8 97 7. If the money is deposited in a traditional ira sep ira simple ira or sarsep ira you will owe taxes at your current tax rate on the amount you withdraw. 2020 ira minimum distribution tables. Ira and tax tables 2020.

Roth ira contributions quick fact sheet. When owners of a traditional ira reach age 72 they are required to take annual minimum distributions.